Tax management in the United States is one of the most important pillars of maintaining sound financial health, both personally and as a business. Whether you are starting a business, self-employed, investing in real estate or simply organizing your personal finances, understanding how the tax system works is key to avoiding costly mistakes and taking advantage of every legal opportunity that will allow you to pay less taxes responsibly and strategically.

For businesses, tax planning is directly proportional to their growth and sustainability. For individuals, proper management of their taxes represents peace of mind, compliance and savings. However, the reality is that many people -and companies- operate without a thorough knowledge of their tax obligations, and this exposes them to fines, audits, unnecessary payments and even criminal liabilities.

This article provides you with a comprehensive and up-to-date guide to understanding how U.S. tax management works, whether you are an individual or represent a business. We'll explain what taxes you should be aware of, how to avoid common mistakes, what the best practices are, and how a tax consultancy like JJRB can help you simplify processes, stay compliant and optimize your tax burden.

Because paying taxes is an obligation. But managing them well... It's a smart strategy.

What tax management for individuals and businesses involves and why it should not be underestimated

When we talk about tax management, we don't just mean filling out forms or filing annual returns. It is a continuous process that involves planning, financial analysis, regulatory compliance and a clear strategy to optimize tax payments without breaking the law.

Both individuals and businesses in the U.S. are subject to a diverse set of taxes and tax liabilities. But the difference between simply "paying taxes" and managing taxes professionally can mean thousands of dollars saved, less legal risk and greater control over your financial future.

What does tax management really cover?

To understand the magnitude, here is a breakdown of the main aspects of effective tax management:

a) Identification of tax obligations

Each taxpayer (individual or company) must identify:

- What federal, state and local taxes you must pay.

- How often you must declare (monthly, quarterly, annually).

- Which forms to use (1040, 1120, 1065, etc.).

- What are the deadlines and conditions for each presentation.

b) Tax Planning

It involves anticipating tax events in order to:

- Calculate the expected tax burden.

- Make smart decisions to reduce it (such as using deductions, tax credits, write-offs or legal structures like LLC or S Corp).

- Establish financial reserves for the payment of taxes.

c) Documentary organization and accounting records

Have control of:

- Income and expenses.

- Valid invoices, receipts and vouchers.

- Payroll (if you have employees).

- Previous declarations, estimated payments, etc.

d) Regulatory compliance and filing of declarations

It's not just about paying. Management includes:

- Comply with established deadlines.

- Submit all forms correctly.

- Avoid errors that trigger audits or fines.

- Comply with IRS and state agency regulations.

e) Continuous strategic assessment and advice

The tax environment changes, just like your financial situation. That's why it's vital:

- Review your fiscal decisions annually.

- Adjust your strategy according to revenues, legal changes or new investments.

- Evaluate with a tax consultant which structure or benefits suit you best.

Why should it not be underestimated?

Because the lack of fiscal management is one of the most costly mistakes that both an individual and a company can make. Underestimating this process means:

- Overpaying out of ignorance.

- Exposure to penalties for omissions or errors.

- Miss out on deduction, credit or planning opportunities.

- Having a distorted view of actual financial health.

Whether you are a freelancer, entrepreneur, small business owner or simply manage your investments, tax management is not optional: it is a tool for protection and growth. It's not about being an expert, it's about having the right support to make informed decisions.

At JJRB, we help our clients stop improvising on their taxes and start building a solid, legal and profitable tax strategy. Because paying the right thing is not evasion... it's financial intelligence.

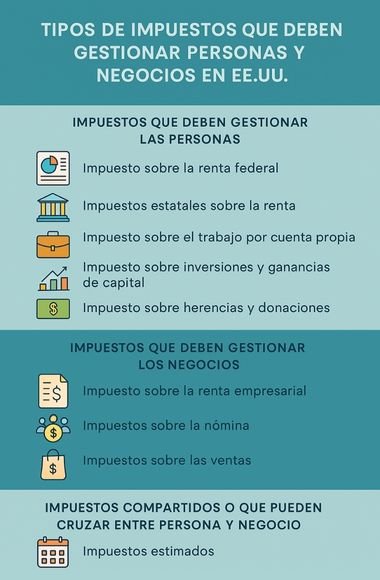

Types of taxes to be handled by individuals and businesses in the USA.

One of the keys to good fiscal management is to understand what taxes apply to your specific situation. In the United States, the tax system consists of federal, state and, in some cases, local taxes.

In addition, there are important differences between what a person must pay and what a business must declare or contribute.

Knowing clearly which taxes you are liable for allows you to plan, comply and optimize without errors.

Taxes to be managed by individuals

In the United States, there are several tax categories that apply depending on the type of income, state of residence and economic activity. The following are the most relevant taxes that every person should know:

a) Federal income tax (Federal Income Tax)

It is the most common. Every person who generates income in the U.S. is required to file a return with the IRS. The rate is progressive and depends on income, marital status and applicable deductions.

b) State income taxes

Not all states apply them (Texas, Florida or Nevada do not), but most do. They are filed separately and have their own forms and fees.

c) Self-employment tax (Self-Employment Tax)

Self-employed individuals must pay the full Social Security and Medicare tax (15.3% combined). This tax replaces the portion normally paid by an employer.

d) Tax on investments and capital gains

Those who invest in stocks, cryptocurrencies, property or funds must declare the gains and pay taxes on them.

e) Inheritance and gift tax

Although it only applies to large amounts, it is important to keep it in mind for estate planning purposes.

Taxes to be managed by businesses

Understanding and complying with tax obligations is crucial to avoid penalties, ensure financial sustainability and contribute to economic development. Below is a breakdown of the most common taxes that businesses need to consider and manage.

a) Corporate income tax

Varies by legal structure (LLC, S Corp, C Corp, etc.). For example:

- C Corporations pay corporate taxes directly.

In LLC or S Corps, the income "passes through" to the owner, who declares it on his personal return.

b) Payroll taxes (Payroll Taxes)

They include withholdings and contributions to Social Security, Medicare, FUTA (Federal Unemployment Tax), and in some states SUTA (state).

c) Sales taxes (Sales Tax)

If you sell taxable goods or services, you must collect the Sales Tax from the customer and remit it to the state. Each state and city has its own rules.

d) Specific state and local taxes

For example, business licenses, use taxes, rental taxes, inventory taxes or personal business property taxes.

Shared taxes or taxes that may cross between person and business

- Estimated Taxes: if not enough of your income is withheld, you must pay it every quarter.

- Penalties and interest for late payments.

- Tax credits available to both individuals and businesses (such as the EITC, Child Tax Credit or clean energy credits).

Knowing what taxes apply is the first step to compliance, but also to identifying opportunities for savings and tax-efficient structures. For example, many small businesses are unaware that they may be overpaying because they did not choose the right structure or claim applicable deductions.

At JJRB we work with individuals and companies to identify their exact obligations and create a clear, legal and cost-effective roadmap. Because knowing what you must pay is as important as knowing what you can legally avoid.

Conclusions

Tax management is not simply a once-a-year administrative task, but an ongoing, strategic practice that can make the difference between growth or stagnation, financial peace of mind or legal chaos. For individuals and businesses alike, understanding your tax obligations, planning ahead and having the right support is critical to operating safely and thriving in the U.S. tax system.

As we have seen, proper tax management involves knowing the types of taxes that apply to each case, avoiding common mistakes such as omitting income or filing returns late, and using legal tools such as deductions, tax credits and corporate structures to reduce the tax burden without breaking the law.

Mistakes in this area can be costly, not only in economic terms -with fines, surcharges and interest- but also in the reputation and stability of a company or family. Therefore, it is vital that both individuals and businesses have professional advice to guide and accompany them at each stage of the tax process.

At JJRB, we know that each case is unique. That is why we offer customized solutions to optimize your tax situation, help you comply without stress, and above all, take advantage of the tax system in your favor. Our commitment is that you don't just pay taxes: you manage them with intelligence, foresight and strategy.

Because at the end of the day, paying taxes is not just an obligation... It's an obligation. is about taking control of your money, protecting your wealth and planning for a better financial future.