The word "tax" often generates concern, confusion or even rejection among taxpayers and business owners. However, in the complex economic and legal environment of the United States, understanding and correctly applying good tax management can make the difference between financial success and costly mistakes. It's not just about complying with IRS regulations: it's about planning, optimizing and protecting your personal or business wealth.

Every year, thousands of individuals and businesses face penalties, accrued interest or audits simply because they do not know how to properly manage their taxes. Others, on the other hand, manage to legally reduce their tax burden, take advantage of available credits and deductions, and project their finances with greater stability thanks to a professional and strategic management of their tax obligations.

In this article we will delve into all the key aspects of tax management in the United States, from the basics to advanced tax planning strategies. We will analyze its impact on both individuals and businesses, explain the most common mistakes, and show you how the right advice - like the one we offer at JJRB - can help you transform your relationship with the tax system, not just by complying, but by getting real value out of it.

Whether you are starting your professional career, managing your own business, or are responsible for the finances of a growing company, this article is designed to give you clarity, confidence and control over your taxes.

What does tax management really involve and why is it so important?

When we talk about tax management, we don't just mean filing an annual return or paying the IRS what is due. Tax management is a continuous, strategic and personalized process that seeks to comply with current regulations while optimizing the tax burden in a legal and efficient way.

What does tax management cover?

It involves much more than filling out forms. Good tax management includes:

- Advance tax planningThe taxpayer's resources are organized in such a way that the taxpayer's future obligations can be met smoothly.

- Evaluation of income and expenses: to correctly classify transactions to access deductions, tax credits and benefits available according to the taxpayer's profile.

- Proactive regulatory complianceAvoid fines, interest or audits by keeping up to date on changes in tax legislation.

- Representation before the IRS: to act in response to requests, audits or notifications, protecting the client's interests.

Personalized consultingThe following are some of the most important decisions to be made: the most convenient business structure, important purchases, inheritances or investments with a clear fiscal vision.

Why is tax management so important in the USA?

Because taxes not only affect your financial present, but also your economic future. Poor management can lead to:

- Loss of deductions and credits.

- Unnecessary or duplicate payments.

- Fines for unintentional errors.

- Audits that paralyze your operations.

- Financial stress and lost investment opportunities.

On the contrary, good management allows:

- To have sufficient liquidity throughout the year.

- Make decisions with fiscal projection in mind.

- Legally lower the tax burden.

- Build reliable financial history.

- Operate with peace of mind and focus on growth.

Many people and business owners see taxes as something that is solved once a year. But the more successful ones understand that their tax control is part of everyday lifeas important as sales, costs or payroll.

At JJRB, we have accompanied clients who, thanks to proper planning, managed to save thousands of dollars in taxes each year, without leaving the legal framework. Because beyond compliance, professional tax management becomes a driver of stability, savings and projection.

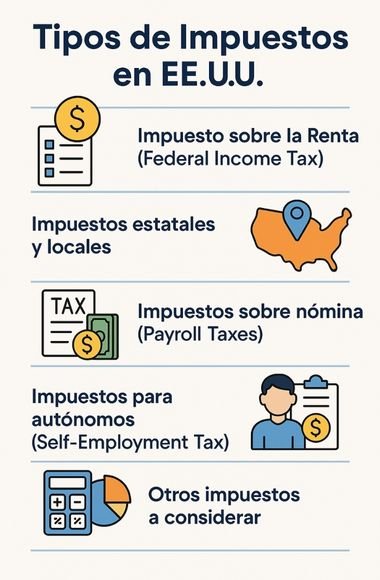

Types of U.S. taxes that every person or company must correctly manage

A key part of good tax management is knowing what types of taxes exist, how they apply depending on the type of taxpayer, and what their key dates are. The U.S. tax system may seem complex, but by understanding the major taxes and their impact, it is easier to stay in control and avoid costly mistakes.

Below is a breakdown of the most relevant taxes for both individuals and companies:

1. Federal Income Tax (Federal Income Tax)

This is the best known tax and affects both individuals and companies. It is progressive, i.e, the higher the income, the higher the percentage paid. It is calculated annually, but may involve quarterly estimated payments if you have income not subject to withholding (such as self-employed or businesses).

For corporations, it is applied according to the type of entity (LLC, S-Corp, C-Corp), and may include:

- Net business income.

- Deductions allowed by law.

- Tax credits for investment, hiring, etc.

State and local taxes

In addition to the federal tax, most states and some cities levy their own taxes. Among them are:

- State income tax (not in all states).

- Sales & Use Tax (Sales & Use Tax).

- Property Tax (Property Tax).

- Specific taxes according to the economic activity.

It is essential to know what applies in your state to avoid double charges or penalties.

3. Payroll Taxes (Payroll Taxes)

These relate to the payment of employees and are of a dual nature:

- What the employer withholds from the worker (Social Security, Medicare).

- What the employer pays additionally as employer's contribution.

In addition, there are federal unemployment taxes (FUTA) and state unemployment taxes (SUTA), the non-compliance of which can generate severe penalties.

4. Self-Employment Tax (Self-Employment Tax)

If you are self-employed or have a sole proprietorship, you must pay this tax, which is due on the first day of the year. covers your share of social security and MedicareYou do not have an employer to hold them for you.

The common mistake is to believe that it is enough to pay income tax, when this tax is additional and can represent more than 15% of your earnings.

5. Other taxes to consider

- Excise Taxfor specific products such as gasoline, tobacco or alcohol.

- Taxes on investmentsapplicable to dividends, capital gains or rental income.

- Inheritance and gift taxesif you plan to transfer assets.

Many people focus only on the income tax, but the real tax risk lies in poorly managed secondary taxespayroll, state, local, investment.

At JJRB, we help our clients to create a complete map of your tax obligationsThe company is committed to ensuring that there are no surprises, that all possible deductions are taken advantage of, and that each obligation is fulfilled accurately and on time.

Knowing what taxes apply to your situation is the first step in exercising a responsible, legal and strategic fiscal management.

Common mistakes in tax management and how to avoid them

Even the most organized individuals or companies can make tax mistakes that end up costing a lot of money, time and reputation. Some of these mistakes are not intentional, but are the result of misinformation, lack of professional advice or the complexity of the U.S. tax system.

Recognizing them and knowing how to avoid them is key to efficient fiscal management.

1. Late filing or failure to file returns

Many people believe that if they do not owe taxes, it is not necessary to file. Nothing could be more wrong. The omission or late filing of returns can generate:

- Non-compliance penalties ($435 or more per missed declaration).

- Interest accrued daily

- Audit risk.

Avoid it: Use reminders, hire an accountant or tax firm, and prioritize filing, even if you cannot pay immediately (it is possible to request a payment plan).

2. Failure to separate personal and business finances

One of the most frequent mistakes among entrepreneurs and freelancers is to mix personal income and expenses with those of the company. This generates:

- Inability to justify deductions.

- Risk of income requalification.

- Confusion in audits.

Avoid it: Use separate bank accounts, keep clear accounting records and issue differentiated vouchers.

3. Ignorance of changes in tax legislation.

Tax laws change every year. Deduct what was valid in 2020 may be penalizable in 2024. Disregarding new rules means:

- Missed savings opportunities.

- Incurring in technical errors that can cost you penalties.

- Apply deductions or credits that no longer exist.

Avoid it: Rely on expert advice such as JJRB, which keeps up to date with IRS and state regulations.

4. Omitting "minor" or alternative income

Freelance income, cryptocurrency, rents, tips or online sales should also be reported. Omit them:

- Break your tax history.

- It can be activated by cross-referencing information.

- Increases the risk of being audited.

Avoid it: Record all income, even if it is informal or digital. Current IRS systems cross-reference information with banking platforms, fintech and e-commerce portals.

5. Not taking advantage of available deductions and credits

Many individuals and businesses pay more taxes than they should simply because of ignorance of tax benefits as:

- Child Tax Credit.

- Credit for education.

- Deductions for business vehicles, rentals or health insurance.

Avoid it: Consult a tax advisor to review your situation and propose a customized tax optimization.

Most tax mistakes are not made out of bad faith, but due to lack of knowledge or lack of time to deal correctly with accounting and taxes. At JJRB, our experience proves that a preventive and professional management is worth much more than correcting errors in haste, under pressure or before the IRS..

Avoiding mistakes is as important as filing correctly. And that can only be achieved with organized systems, basic financial education and an expert team on your side.

Conclusions

Tax management is not a subject reserved for large companies or financial experts. It is a daily responsibility that every person or business in the U.S. must take an intelligent and strategic approach to. What's more, it is a powerful tool for building economic stability, protecting wealth and projecting future growth.

Throughout this article we have covered the fundamental aspects that make tax management an indispensable pillar: from its true meaning and the taxes to be considered, to the most common mistakes and the best practices to avoid them. The message is clear: taxes are not improvised. They are planned.

The consequences of poor management can be severe: from financial penalties to operational blockages. But, on the other hand, those who adopt a well-structured and professional fiscal management, discover legal opportunities to pay less, invest better and live or work with peace of mind IRS.

At JJRB we understand that each taxpayer, whether an individual or a consolidated company, needs a different approach, adapted to their reality and goals. Therefore, our consulting service is not limited to "filling out forms", but seeks to accompany you with vision, proactivity and clear solutions.

If you have come this far, it is because you are interested in improving your relationship with taxes. Our invitation is direct: don't do it alone. Let us help you to transform your tax obligations into a solid growth and security strategy.

Because good tax management it's not just about compliance... it's about moving forward intelligently.