Properly managing personal taxes in the United States can be one of the most complex and overwhelming tasks for any citizen or resident. The variety of forms, federal and state regulations, available deductions, tax credits, and constantly changing tax regulations make Properly complying with the IRS may not always be easy, let alone cost-effective if done without technical knowledge..

At JJRB Tax Consulting we understand that most people are not tax experts. However, we know that the tax impact on your personal finances can be enormous if you do not make informed decisions. A poorly prepared return can not only lead you to overpay, but also to receive fewer refunds, lose valuable deductions or even expose you to penalties and audits.

The good news is that, with a professional consulting in personal tax managementyou can transform a legal obligation into a real savings and planning opportunity. Far from being an expense, having experts to guide you step by step is a smart investment that can protect your wealth, improve your liquidity and give you peace of mind before the IRS.

In this article you will discover:

- What a good tax consultancy for individuals really includes.

- What tax obligations you must comply with if you live or work in the USA.

- How to legally take advantage of tax deductions, credits and benefits.

- What are the most common mistakes when filing self-employment taxes.

- How JJRB can help you simplify, optimize and secure your personal tax management.

And most importantly: you will learn how to take control of your taxes without feeling alone or lost in the process..

What is a personal tax consultancy and why is it so important in the U.S.?

Tax consulting for individuals is a professional service that aims to help you comply correctly with your tax obligations and, at the same time, optimize your tax burden within the current legal framework in the United States.

This includes everything from preparing and reviewing your tax returns, to designing customized strategies to reduce what you pay to the IRS, maximize your refunds and avoid penalties or errors that can affect your finances.

What exactly does a tax consultant for individuals do?

A personal tax advisor doesn't just fill out forms. Their role is much broader:

- Analyze your economic, work and family situation.

- Determine what type of forms to file (1040, 1040NR, 1099, etc.).

- Check to see if you qualify for tax credits such as the Earned Income Tax Credit (EITC), the Child Tax Credit (CTC), the Earned Income Tax Credit (EITC), theor deductions such as medical, educational, housing, among others.

- Evaluate whether you can report expenses related to investments, small businesses or rental property.

- Advises you on proper withholding on your W-4.

- It helps you plan your estimated tax payments if you are self-employed or freelancer.

- Offers representation before the IRS in case of audits or requirements.

Why is this service so important in the U.S.?

Unlike other countries, the U.S. tax system is:

- Self-declarativeYou are the one who must calculate and report your income, expenses and deductions. Failure to do so correctly may result in legal consequences.

- ComplexThe following is a list of the most important aspects of the company's business activities: it includes federal, state and local standards, as well as specific regulations for different sources of income.

- AuditedIRS cross-checks information and can audit any taxpayer, even for unintentional errors.

- ChangeableTax laws change from year to year. An advisor keeps up to date and protects you from making mistakes due to misinformation.

Many U.S. citizens and residents rely solely on automated tools to do their taxes. While they may work for simple cases, in situations with varying incomes, dependents, investments or property, the risk of making mistakes increases dramatically.

At JJRB, we have seen how our clients have been able to not only avoid costly mistakes, but also to recovering thousands of dollars in unused deductions thanks to professional tax advice. Because when it comes to personal taxes, knowledge makes the difference between paying the right amount... or overpaying.

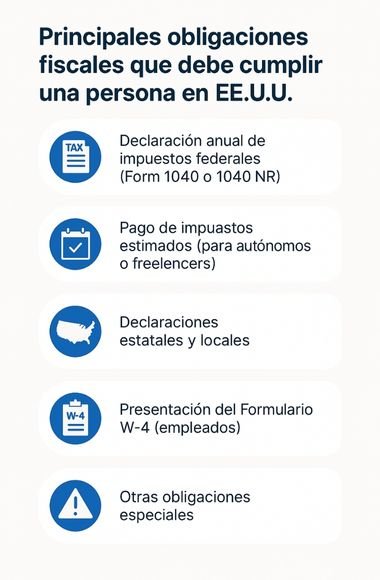

Main tax obligations that a person must comply with in the U.S.

The United States has a fiscal system based on the principle of self-declarationThis means that every taxpayer is responsible for correctly reporting their income and paying the corresponding taxes. While this sounds simple in theory, in practice it involves a series of obligations that vary depending on your immigration status, the type of income you generate, and the state where you live or work.

Below, we explain the main tax obligations that a person must comply with in the U.S., whether a citizen, resident or foreigner with income in the country:

One of the most common mistakes among entrepreneurs and managers is to think that management consulting is "just another expense". Nothing could be further from the truth. A good consultancy - well applied, with clear objectives and an effective methodology - generates concrete, measurable and sustainable returns over time.

In this section we will discuss some of the most important benefits you can expect when your company works hand in hand with specialized business management consultants:

1. Annual Federal Income Tax Return (Form 1040 or 1040NR)

All U.S. citizens, permanent residents (green card holders) and certain foreign nationals must file an annual tax return with the IRS. This return is filed on form 1040 (for residents) or 1040NR (for non-residents).

This statement reports:

- Wage income (W-2).

- Self-employment income (1099-NEC or 1099-MISC).

- Investment earnings or dividends.

- Income from rents, pensions, interest, etc.

- Deductions and applicable credits.

The usual deadline is April 15although it may vary slightly from year to year.

2. Estimated tax payments (for freelancers or self-employed)

If you are self-employed or generate income that is not subject to automatic withholding (such as rents or investments), you must do the following estimated tax payments each quarter to the IRS. Failure to do so may result in penalties for nonpayment or underestimate.

3. State and local declarations

In addition to federal taxes, many states and some cities also require you to file returns. Each state has its own rules, forms and deadlines. Some states, such as Florida or Texas, do not charge personal income tax, but others, such as California or New York, have complex systems.

4. Filing Form W-4 (employees)

If you work as an employee, you must complete a W-4 form so your employer knows how much to withhold from your paychecks. A poorly filled out W-4 can result in insufficient withholding... and an unpleasant surprise at the end of the year.

5. Other special obligations

Depending on your situation, you may also be required to:

- Report foreign bank accounts (FBAR or Form 8938).

- Report aggregate income if you are a citizen or permanent resident.

- File supplemental forms if you receive scholarships, retirement plan distributions, social security benefits, etc.

Complying with all these obligations is not an easy task. Many taxpayers they don't even know they have to file state returns or who are required to report income earned outside the country. And most worrisome: ignorance does not exempt you from fines.

At JJRB we focus on providing a service that not only helps you comply, but educates you and gives you peace of mind. Our goal is that you can focus on your life, your work and your goals, knowing that your tax affairs are in expert hands. Because complying with the IRS doesn't have to be a headache... if you're well advised.

Personal tax credits and deductions: how to pay less tax legally

One of the major advantages of having professional tax advice is learning to legally reduce your tax burden through deductions and tax credits. The U.S. tax code offers multiple opportunities for taxpayers to pay less tax, but many of these benefits are lost due to ignorance or errors in filing.

At JJRB we help our clients identify and correctly apply these tools, maximizing their refunds and avoiding unnecessary tax payments.

What is the difference between tax deductions and tax credits?

- DeductionsThey reduce the amount of your taxable income. For example, if you earned $50,000 a year and you have $10,000 in deductions, you will only pay tax on $40,000.

- Tax creditsDirectly reduce the amount of tax you owe. If after applying deductions you owe $3,000 in taxes and you qualify for a credit of $1,000, you will only pay $2,000. Some credits are reimbursablewhich means that if the credit exceeds your taxes, the IRS refunds the difference in cash.

Common personal deductions

- Standard deductionAvailable to all taxpayers. In 2024, for example, it is $13,850 for single filers and $27,700 for married filing jointly.

- Mortgage interestIf you own your own home, you can deduct the interest on your loan.

- Medical expensesIf they exceed a percentage of your income, they may be deductible.

- Retirement plan contributions (IRA, 401(k))They reduce your taxable income.

- Educational expensesSome tuition expenses may be deductible or qualify for credit.

- Donations to non-profit organizationsProvided they are registered with the IRS.

Tax credits highlighted

- Earned Income Tax Credit (EITC)For people with low to moderate income. May exceed $7,000 if you have dependent children.

- Child Tax CreditUp to $2,000 per child under 17 years of age.

- American Opportunity Credit and Lifetime Learning CreditFor higher education.

- Saver's CreditIf you contribute to a retirement plan with low to moderate income.

- Dependent care creditsIf you pay for day care or elder care.

Every year, millions of people pay more taxes than they should simply because they are not aware of the tax benefits available or because they use generic tools that do not analyze their particular situation. At JJRB, we don't just fill out forms: we study each case and look for every legal opportunity so that you pay only what is fair, not a dollar more.

Professional advice can mean the difference between receiving a $500 refund or a $2,000 refund. Between paying $3,000 to the IRS or reducing it to $1,500 with well applied credits. Because information, in tax matters, is power and savings at the same time.

Conclusions

Proper management of personal taxes in the United States is much more than a simple annual formality: it is an essential component of your financial stability, peace of mind and wealth growth. In a system as demanding and ever-changing as the U.S., trying to tackle this process alone - with complex forms, tight deadlines and varying state regulations - can lead to costly mistakes, loss of tax benefits and even legal trouble with the IRS.

As we have seen throughout this article, a professional tax consultancy for individuals offers much more than filling out forms. It means having personalized guidance for:

- Comply correctly with all your tax obligations.

- Legally reduce your tax burden through deductions and credits.

- Prevent errors and avoid audits or penalties.

- Make informed decisions about your money, your investments and your future.

At JJRB Tax Consulting we believe that everyone deserves to pay only what is fair, with security, support and clarity. That is why we specialize in providing an accessible, reliable and strategic service that transforms your taxes from a complicated process... into a personal control and planning tool.

Whether you are an employee, freelancer, investor, newcomer to the country or a professional with years in the U.S., remember this: your taxes are not something you have to figure out alone or at random. With the right support, you can comply with the IRS, protect your income and make better decisions with your money.

Get advice from JJRB and turn your taxes into an advantage, not a burden.