Bookkeeping is the systematic process of recording, classifying and organizing all the financial transactions of a business in chronological order. Although often confused with general accounting, bookkeeping is the foundation on which all financial statements are built and fiscal and strategic decisions are made. Without bookkeeping, there is no reliable data to generate reports, comply with taxes or understand the real state of the business.

This article is designed to explain:

- What bookkeeping really is and what differentiates it from tax accounting.

- Why it is essential in the USA, even for small businesses or individual ventures.

- What benefits are generated by having a professional and continuous bookkeeping system.

- What are the tools, processes and best practices to do it efficiently.

- And how JJRB can help you implement a customized bookkeeping service aligned to your goals, industry and tax obligations.

Because you can't make good financial decisions without good accounting information, and the first step is to have professional, accurate and up-to-date bookkeeping.

What does bookkeeping include?

Some of the essential elements of a professional bookkeeping service include:

- Daily record of receipts and disbursements.

- Bank reconciliation (review and comparison of bank movements with the books).

- Accounts payable and receivable management.

- Accounting classification according to the type of transaction.

- Control of operating expenses, payroll, purchases and investments.

- Preparation of basic financial reports (balance sheet, income statement).

- Documentary and digital support for internal or external audits.

The objective is to generate a clear, orderly and updated database that allows access to financial information at any time, whether for internal decisions, tax filing or to apply for financing.

How is it different from the accountant's work?

The bookkeeper focuses on the capture and organization of accounting data. On the other hand, the accountant analyzes that information, interprets the results, formulates tax strategies and prepares IRS returns. In other words:

- The bookkeeper registers.

- The accountant interprets.

Both profiles are essential, but without a good bookkeeping base, the accountant's work becomes more costly, time-consuming and inaccurate.

Many small businesses make the mistake of leaving bookkeeping "for later" or only focusing on it during tax season. This is a serious mistake: keeping your books up to date not only avoids penalties, but also gives you real control of your finances..

At JJRB we have seen cases where the implementation of a good bookkeeping system has allowed businesses to identify unnecessary expenses, improve their profitability and even increase their valuation for investors. It is not about having perfect books, but about having useful, clear and reliable information to support every decision.

In a business environment as competitive and regulated as the U.S., keeping financials up to date is not an option: it is a critical necessity for any business that aspires to grow with stability, meet its tax obligations and make informed decisions. This is where the bookkeepingor basic accounting, becomes the backbone of corporate financial health.

Bookkeeping is not just about recording income and expenses. It's about building a structured and reliable accounting base that supports every aspect of your business: from tax returns to strategic projections. Disorganized, delayed or poorly maintained bookkeeping can lead to everything from IRS penalties to significant financial losses and problems with partners or investors.

At JJRB Tax Consulting we understand that many entrepreneurs, especially in the initial or growth stages, see bookkeeping as a tedious or dispensable task. But experience shows us that businesses that invest in professional bookkeeping from the beginning are the ones that achieve greater stability, projection and profitability in the long term.

Why is bookkeeping so important to comply with IRS and U.S. tax laws?

The United States has one of the strictest, most complex and heavily taxed tax systems in the world. Every year, millions of businesses must file returns with the IRS (Internal Revenue Service) and state and local tax agencies. To do this correctly - and avoid penalties - it is essential to have clear, orderly and verifiable financial records. This is where bookkeeping plays an irreplaceable role.

The IRS is not satisfied with estimated or "approximate" returns. Every figure you submit on your tax forms must be supported by accounting records and supporting documents, such as invoices, statements, receipts, contracts, etc.

Without a professional bookkeeping system:

- You will not be able to justify your tax deductions.

- You are likely to omit income or duplicate expenses.

- You will be more exposed to audits, fines or penalties.

- You will waste time and money trying to "rebuild" your finances at tax time.

On the other hand, if your books are up to date, filing your taxes becomes an orderly, fast and secure process. In addition, errors are greatly reduced and it is easier to legally take advantage of all available credits and deductions.

Withholding and payroll requirements

If you have employees, the IRS requires you to keep detailed records on:

- Salaries paid.

- Taxes withheld (federal, state, local).

- Forms filed (such as W-2 or 941).

- Social Security and Medicare contributions.

Proper bookkeeping takes care of recording and organizing all this information on a month-to-month basis, allowing you to avoid retention errors, compliance issues and labor penalties.

Thinking that "just keeping the receipts is enough" is a common mistake. In practice, when a notice from the IRS arrives, what is being assessed is consistency between what is declared and what is recorded. And if your books are not in order, not even the best accountant in the world will be able to protect you completely.

At JJRB we have helped multiple companies overcome audits thanks to solid and supported bookkeeping. The difference between a smooth audit and a financial crisis is in how you keep your books each month. Invest in bookkeeping is to invest in legal and tax protection for your business.aThe United States has one of the strictest, most complex and heavily taxed tax systems in the world. Every year, millions of businesses must file returns with the Internal Revenue Service (IRS) and state and local tax agencies. To do this correctly - and avoid penalties - it is essential to have clear, orderly and verifiable financial records. This is where bookkeeping plays an irreplaceable role.

The IRS is not satisfied with estimated or "approximate" returns. Every figure you submit on your tax forms must be supported by accounting records and supporting documents, such as invoices, statements, receipts, contracts, etc.

Without a professional bookkeeping system:

- You will not be able to justify your tax deductions.

- You are likely to omit income or duplicate expenses.

- You will be more exposed to audits, fines or penalties.

- You will waste time and money trying to "rebuild" your finances at tax time.

On the other hand, if your books are up to date, filing your taxes becomes an orderly, fast and secure process. In addition, errors are greatly reduced and it is easier to legally take advantage of all available credits and deductions.

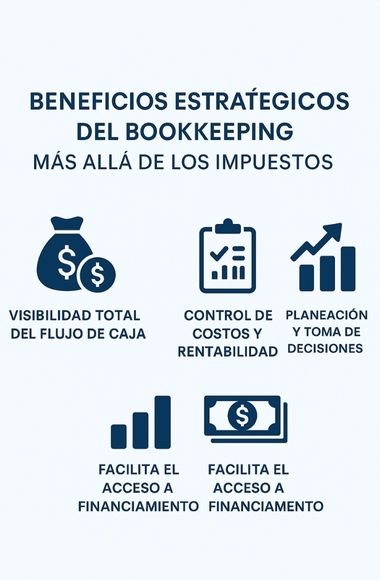

Strategic benefits of bookkeeping beyond taxes

When talking about bookkeeping, many people associate it only with tax filing. However, professional basic bookkeeping goes far beyond tax compliance: it becomes a powerful tool for making strategic decisions, optimizing processes and projecting business growth.

At JJRB, we have accompanied multiple companies that, thanks to a well-managed bookkeeping system, have radically improved their operational efficiency, profitability and expansion capacity. Here's why.

Full cash flow visibility

Knowing clearly how much is coming in, how much is going out, and at what times, is fundamental to avoid liquidity problems. An up-to-date bookkeeping system allows you to:

- Anticipate drops in income or peaks in expenses.

- Avoiding bank overdrafts.

- Plan payments to suppliers and payroll without improvisation.

- Evaluate whether it is viable to assume new investments or credits.

2. Cost control and profitability

When expenses are accurately recorded and correctly categorized, you can clearly identify:

- Which areas of the business are most profitable.

- Which products or services generate losses.

- What expenses can be cut without affecting the operation.

- How to improve margins and increase profits.

3. Planning and decision making

With clear and organized financial information, you can make informed decisions, such as:

- Expanding a product line.

- Hiring new personnel.

- Open a new headquarters.

- Negotiate with investors with real figures in hand.

In addition, monthly financial reports allow you to monitor your objectives and make adjustments in real time.

Having well-prepared financial reports is of little use if you don't know how to interpret them. An accounting consultant converts that data into inputs for strategic decisions, such as:

- When to hire personnel.

- Whether it is viable to invest in a new business unit.

- Which products or services generate the highest profitability.

- How to plan for growth without putting liquidity at risk.

4. Facilitates access to financing

Banks, investors and support funds need to see your financial statements, not promises. A business that keeps its bookkeeping up to date projects order, accountability and transparency. This:

- Improve your credit profile.

- Increases member confidence.

- Speeds up loan or investment approval processes.

Bookkeeping is not just an IRS requirement: it is a real competitive advantage. At JJRB, we see it every day. Two businesses with similar revenues can have totally different results: one struggles to stay afloat, the other grows in an orderly fashion. The difference? One has its accounting up to date; the other does not.

Implementing a good bookkeeping system allows you to stop guessing and start deciding with real data. And in a world where every financial mistake is costly, that clarity is worth gold.

5. Accompaniment before audits or requirements

If the IRS contacts you for a review, you don't have to face the process alone. An accounting consultancy provides you with technical support and professional representation, avoiding miscommunications and ensuring that your documentation is in order.

At JJRB we have accompanied companies that, after years of operating with a basic accounting system, have discovered thanks to a consultancy that they were losing thousands of dollars due to misinformed decisions, incorrect record keeping or tax inefficiency.

Our goal is not only to help you deliver, but to help you grow strong. Because every number has a story... and a strategic potential.

Conclusions

The bookkeepingfar from being a simple administrative task, it is the foundation on which the healthy and sustainable finances of any business are built. In a country like the United States, where tax compliance is rigorous, financial control is key and competition is fierce, keeping professional, accurate and up-to-date basic accounting records is not optional: it is a strategic obligation..

Throughout this article, we have seen that bookkeeping:

- It is essential to comply with the IRS and avoid penalties.

- It provides clarity on cash flow, costs and profitability.

- Provides real data to make informed decisions and plan for growth.

- Facilitates access to financing, investors and new markets.

- Reduces legal, accounting and operational risks.

At JJRB we know that many entrepreneurs and small business owners feel that bookkeeping is a burden. But the truth is ignoring this part of the business can cost a great deal more in the long runThe company has been involved in fiscal mistakes, wrong decisions or missed opportunities.

Therefore, our recommendation is clear: invest in keeping your books up to date right from the start. It doesn't matter if you are a freelancer, a startup or a company with several years in the market. Having a professional bookkeeping system, backed by experts, will give you the peace of mind you need to focus on what really matters: growing your business.

At JJRB we are ready to help you implement a bookkeeping system tailored to your needs, aligned with US tax laws, and designed to turn your finances into a true tool for control and expansion. Because a business that knows its numbers, knows its power.